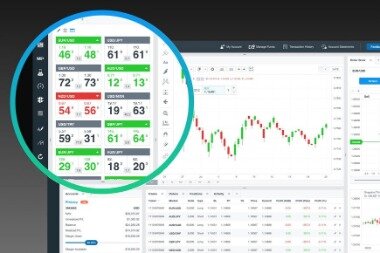

“Weaker trading across oil and gas which should be expected by the market given lower gas prices and the seasonality of Shell’s LNG portfolio.” Reuters, the news and media division of Thomson Reuters, is the world’s largest multimedia news provider, reaching billions of people worldwide every day. Reuters provides business, financial, national and international news to professionals via desktop terminals, the world’s media organizations, industry events and directly to consumers. Energy resources are an important component of exchange trading because assets in this category are of high value in the investment activities of many large private investors as well as institutional investors. These instruments can be purchased on one of the existing commodity exchanges listed below. Crude oil is one of the most critical resources on the planet; its price reflects the state of the world economy.

Global crude oil benchmarks such as the Brent oil futures contract (which incorporates several North Sea crude oil) are actively traded on ICE. Brent is a worldwide benchmark with approximately 70% of global crude priced off the benchmark. The changes to supply and demand for energy globally presents an opportunity to trade these markets.

What Are Different Types of ETRM

Electricity is a local product that is actively traded in the United States. Since you cannot store electricity for more than a few days (via a battery), the price is driven by demand and the cost of supply. The CME provides several active electricity contracts that are based on specific locations throughout the United States.

Energy is produced and consumed through energy assets, such as refiners and utilities. Companies like these as well as producers and distributors of energy are traded on stock exchanges worldwide. The energy sector is a massive part of worldwide global commerce and will likely continue to change in the decades to come. While the short-term outlook is mixed, the long term outlook favors the additional use of electricity as a replacement for fossil fuels. Electricity will likely continue to replace fossil fuels used in transportation as electric cars sales expand.

XBID: Cross-European intraday trading

The lead-time varies between power exchanges but can be as short as five minutes in the case of the EPEX Spot. One of the earliest forms of an energy market emerged in 1980, when Chile privatized its power industry. Other Latin American countries, such as Argentina, followed suit in the early 1990s and adopted elements of Chile’s newly-liberalized power sector. In 1990, England was the first European country to establish a liberalized power trading market, and its model was adapted for other Commonwealth countries. Even though the English market predated a European market, the European Commission was already working on plans for a European energy market in the 1980s. During the 1990s, several European countries began liberalizing their power markets, which included efforts to unbundle power generation and distribution.

- You would get paid that “time” regardless of how long it took you to get to your destination.

- However, there is a category of assets that have always been valued in exchange trading due to their unique characteristics and properties.

- Traders are deploying these tools as markets become more real time to keep a competitive edge and to maintain or increase trading margins.

- Since you cannot store electricity for more than a few days (via a battery), the price is driven by demand and the cost of supply.

- The advantage of buying gas at the exchange trading is the reduction of costs compared to OTC supplies.

Some of the most popular types of energy derivatives are those relating to crude oil. For example, NYMEX WTI Light Sweet Crude Oil futures trade nearly 1.2 million contracts a day, according to the CME, with each contract representing 1,000 barrels of oil. Energy derivatives are financial instruments whose underlying asset is based on energy products, including oil, natural gas, and electricity. They can either be traded on a formal exchange, such as the Chicago Mercantile Exchange (CME), or on an over-the-counter (OTC) basis.

Different Types of Energy

RES electricity generation is usually intermittent and difficult to predict. When consumers have a surplus of electricity, they can store it using energy storage devices, export it back to the https://trading-market.org/4-steps-to-using-the-inside-bar-for-trading/ grid, or sell it to other energy consumers. This technology opens up new opportunities for all network participants, for example, to choose whom to sell electricity to and from whom to buy it.

These energy commodities are traded in the futures market but can also be traded on OTC markets as forward contracts. Energy ETFs and stocks of energy companies are also traded on the equity market. Energy professionals need to move beyond legacy systems to make a cut in the competition.

That way, if the price of oil suddenly increases during the year, the company will not suffer from any unexpected increase in their production costs. A number of companies have recently accelerated development of trading desks focused on these commodities, which offer higher trading margins. Also, a direct presence in the market can help industrial companies gain a better grasp of the price discovery https://currency-trading.org/currency-pairs/gbp-chf/ process. For example, a number of major global and niche trading firms have recently announced the creation of carbon renewable certificates and biofuel-ticket trading desks. Oil and gas companies have developed biofuels trading desks dedicated to feedstocks such as vegetable oils, UCOs, and other waste oils, as well as products such as FAMEs and hydrotreated vegetable oils (HVOs).

As part of the transformation, the role of traders progressively shifted from taking decisions and executing trades toward focusing on market analysis and improving advanced analytics models on a continual basis. Fourth, the energy and wider environmental transition is giving rise to new commodities (for example, biofuels, renewables guarantees of origin certificates, lithium, and cobalt). These commodities, while initially traded on a bilateral basis, very quickly evolve into over-the-counter (OTC) trading markets with limited liquidity that require strong price risk management. Second, markets are trading in real time more than ever; for example, power and gas can now trade in slots of only 10 minutes in a number countries compared with daily a few years ago. As a result, companies are rolling out new intraday trading teams and algorithmic models to cope with this new market structure.

How Does Energy Trading Work?

In the coming decades, India and other emerging countries will have to trade power grid infrastructures as their economies begin to show positive growth. According to a report by ExxonMobil, the industrial demand for energy in India will increase threefold by 2040. The predicted flat growth for energy in developed nations is not because their https://forex-world.net/software-development/software-solution-architect/ economic conditions are bad rather they will benefit from greater energy efficiency in the long run. The agency believes the increase in electric cars will be a headwind for oil growth and drive electricity growth. The EIA believes that by 2040 there will be 330 million electric cars on the road up from an estimate of 300 million in 2018.

Unused renewable energy an option for powering NFT trade … – Cornell Chronicle

Unused renewable energy an option for powering NFT trade ….

Posted: Mon, 10 Jul 2023 19:02:46 GMT [source]

At the same time, commodity trading has become much more competitive. For example, big industrial companies that purchase large volumes of power and gas are setting up trading desks to procure these products directly on wholesale markets. Oil and gas companies are developing power and carbon emissions trading desks, increasing competition with utilities. New, independent companies are trading power and gas as a service for smaller-scale producers or buyers. Other niche players are also trading new commodities such as biofuels and carbon certificates.

What Is Energy Trading?

In this energy commodity guide, we explain what types of energy commodities make up the energy market. Trading financial products carries a high risk to your capital, particularly when engaging in leveraged transactions such as CFDs. It is important to note that between 74-89% of retail investors lose money when trading CFDs. These products may not be suitable for everyone, and it is crucial that you fully comprehend the risks involved. Prior to making any decisions, carefully assess your financial situation and determine whether you can afford the potential risk of losing your money.

Commodity assets such as crude oil, natural gas, and electrical power are traded around the globe. In addition, the companies that produce, refine, transport, store and consume energy are actively traded on stock exchanges around the world. First, energy markets in particular are becoming more globally interconnected.

What is Power Trading?

It is also worth noting that power trading has been gaining in popularity recently. The electricity market is highly diversified and accommodates many energy companies whose job it is to produce and supply energy. Energy trading refers to the buying and selling of different energy commodities such as natural gas, oil, gasoline, heating oil, and even electricity.

To ensure better market coupling and to allow cross-border intraday trading, EPEX Spot, Nord Pool, GME and OMIE established a harmonized trading system called XBID. Fossil fuels such as oil, gasoline, heating oil, gas-oil, residual fuels, coal, and natural gas have active to relatively active futures markets. A futures contract is the obligation to either buy or sell an asset at a date in the future. A futures contract has a fixed volume and trades on a regulated exchange. The two most active energy exchanges are the Chicago Mercantil Exchange (CME) and the Intercontinental Exchange (ICE). Smart grid technology, more efficient natural gas-fired power plants, and fuel-efficient cars are some of the positive innovations that could bring about a new revolution in energy efficiency.