Libra’s scam account has been on Twitter since March 2018, but rumors about Facebook’s potential token haven’t begun circulating until the second half of 2019. There hasn’t been any activity on the account before Jan. 25 and the smart contract for the launch of the LIBT token has been created on Jan. 26. Time and again, financial innovation has given rise to types of financial intermediation that operate outside the regulatory framework, often bringing lower costs, better services, or more choice. But sooner or later—as a result of a crisis or otherwise—we must reset the parameters of regulation to bring these new innovations into the fold.

The SEC filed suit earlier this year, claiming that the $100 million offering was illegal because it was not registered with the agency. The unit of currency is called “Libra.” Libra will need to be accepted in many places and easy to access for those who want to use it. In other words, people need to have confidence that they can use Libra and that its value will remain relatively stable over time. Unlike the majority of cryptocurrencies, Libra is fully backed by a reserve of real assets.

The Libra Coin ICO — so far

There were unquestionably some huge successes to emerge from the ICO era. Near the top of that list are Aave (AAVE), Filecoin (FIL) and Cosmos (ATOM). Each is a substantial part of the blockchain ecosystem nearly six years after their initial fundraising push, and have generated huge returns for ICO investors. It’s hard to nail down a clear starting point for the “ICO era,” but one signpost might be with the $60 million failure of The DAO in 2016.

- Instead of having to recruit its own miners or validators, a project could rely on the existing security of the Ethereum blockchain.

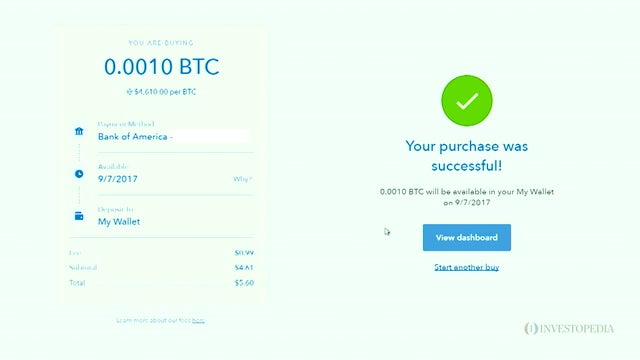

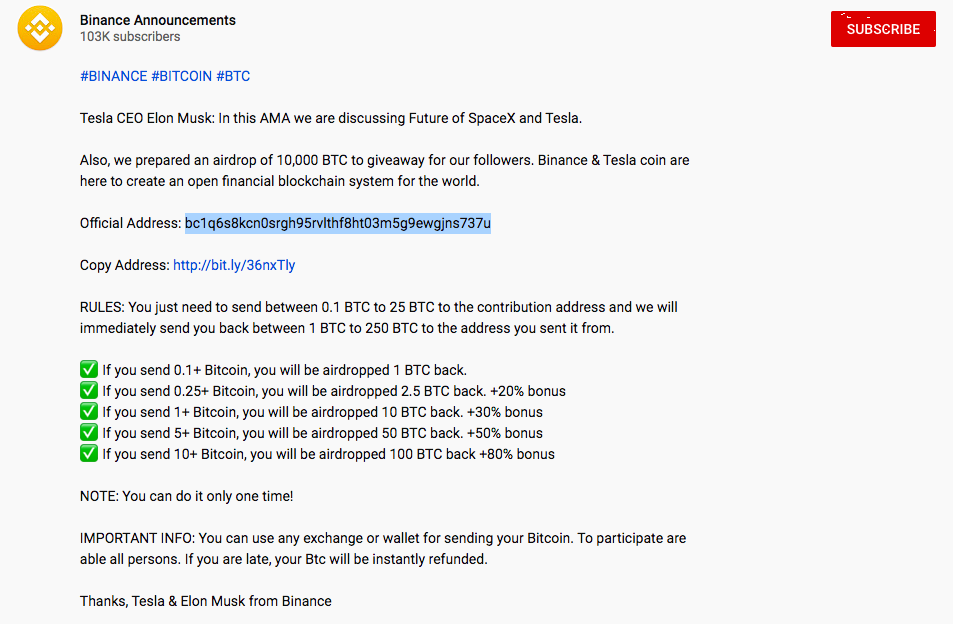

- According to the Twitter account, investing 0.1 ETH would translate into 300 million LIBT, while investing 0.5 ETH would yield 3 billion LIBT.

- If the abundance of spelling and grammatical errors didn’t raise any red flags, the broken mathematics of the pre-ICO certainly did.

- That’s not an obvious choice, because these “initial coin offerings” (ICOs) were not unambiguously a Good Thing.

- Some crypto enthusiasts have been quick to point out that the centralized control by the Libra Association is antithetical to the decentralized promise of blockchain technology.

- ICO tokens were intended to grow in value, not because they represented a claim on revenue on a common enterprise, but based on the arguments in Joel Monegro’s “Fat Protocols” thesis (Monegro is a prominent VC with Union Square Ventures).

Fraudster claim that they have raised 3 ETH in the public sale is backed by data from Etherscan. However, a closer investigation has shown that transactions of 1 and 2 ETH have both come from the same address that had little other activity. As noted by crypto news outlet CryptoSlate, the address has received 3 ETH so far. However, a closer analysis reveals that almost all the 39 transactions conducted so far have been virtually empty.

Binance Labs invests $5M in Curve DAO Token following $60M July hack

But there are major differences between what investors in ICOs and IPOs are actually buying. While IPO investment gains are premised on growing corporate revenues, ICO tokens only rise in value because people want to use them. Broadly, this is the “utility token” thesis that was believed by some to separate token sales from securities offerings. Ten years ago, Satoshi Nakamoto proclaimed that Bitcoin could provide a peer-to-peer means to transfer value that could eliminate or at least reduce our reliance on large centralized financial intermediaries. It was an especially attractive idea in the aftermath of the 2008 financial crisis, but one that has not been realized.

Solanaland Set To Commence Pre-sale Of Utility Token – Bitcoinist

Solanaland Set To Commence Pre-sale Of Utility Token.

Posted: Sat, 25 Mar 2023 07:00:00 GMT [source]

The account is clearly a scam, but judging by its ETH transactions, it hasn’t managed to defraud investors. For just 0.1 ETH, the scammers promise 100 million LIBT tokens, with the offers extending all the way to 15 billion tokens for 2 ETH. Once the Libra network launches, Facebook, and its affiliates, will have the same commitments, privileges, and financial obligations as any other Founding Member.

Tether ‘welcomes’ PayPal’s PYUSD stablecoin to the market, says CTO Paolo Ardoino

Over time, in theory, it should make participating individuals much smarter investors, ultimately leading to a “safer” market than any regulation could impose – at least after a sufficient period of hard lessons. Most notably, Telegram’s plan to tokenize the network and sell a TON token was a technically defensible idea that might have been transformative, but serious pressure from the SEC in 2019 led to its cancellation. Also in 2019, the SEC sued messaging platform Kik for its 2017 token sale, eventually leading to a $5 million settlement. But the further you get off-chain with any feature of a distributed ledger, the more this model breaks down, for at least two reasons.

The Libra Association is an independent, not-for-profit membership organization headquartered in Geneva, Switzerland. The association’s purpose is to coordinate and provide a framework for governance for the network and reserve and lead social impact grant-making in support of financial inclusion. The association’s membership is formed from the network of validator nodes that operate the Libra Blockchain. Due to the complexity of the underlying projects, experts argue that investors need to have the technical expertise to be able to evaluate whether investing in an ICO makes sense. Moreover, the startup itself should provide sufficient information for investors to evaluate the investment. The Securities and Exchange Commission is said to be taking a hard look at the increased use of such offerings, with the growth of so-called ICOs surging in recent months.

Flow blockchain resilience amid global NFT decline in Q2 2023

It has already garnered 12,000 followers, though many of them look like they could be bots to trick unsuspecting people into thinking it’s legitimate. With the uncertainty surrounding the launch date of Facebook’s highly anticipated Libra project, scammers have now taken to Twitter to flog a fake Libra Initial Coin Offering (ICO). PYUSD is being pitched as good for sending person-to-person payments, transferring to external wallets or funding purchases and users can convert PYUSD to other PayPal-supported digital assets. The Twitter account has 12,000 followers, but according to analysis by SparkToro, 41% of these are fake accounts and bots.

The 3 ETH have been from one address in two transactions – one of 1 ETH and the other 2 ETH. This address hasn’t done much else other than these two transactions, a clear indication that the scammers used it to make it seem like investors were genuinely investing. The offer seems to be getting better by the day as just a day later, 2 ETH would get you 100 billion LIBT tokens. Interestingly, the account’s first tweet claimed that Libra will have a maximum supply of 500 billion tokens. And if the logic of the token distribution isn’t enough to spook you, the tweets are full of spelling mistakes as well.

What was an ICO?

Blockchain-based Kin enabled them and their developers to both guarantee the scarcity of a digital asset and move it around easily without having to trust an intermediary. Facebook’s plans for Libra sound ambitious, risky and novel — but a predecessor exists that can shed light on some of the company’s motivations, and possibly the shape it wants the project to ultimately take. Some people are already betting on whether the ICO is really happening next year or not. However, although there are still plenty of regulatory issues pending to be solved, the Libra technology ecosystem keeps growing and there are already many startups who will be ready and available to offer Libra-based solutions from day one.

- Some people are already betting on whether the ICO is really happening next year or not.

- This address hasn’t done much else other than these two transactions, a clear indication that the scammers used it to make it seem like investors were genuinely investing.

- The fact that the association will encourage the listing of Libra on electronic exchanges and will have the power to change the composition of the reserve may raise eyebrows at the SEC.

- Most importantly, if you were one of those informed, careful and lucky investors, you were able to profit from your insights regardless of your geographic location or citizenship.

But The DAO was catastrophically hacked before it could launch, resulting in an extended state of emergency for Ethereum as a whole. Meanwhile, projects that had expected to take funding from The DAO were left high and fitcoin price dry, searching for an alternative model. That’s why I, and many others, at the time felt the designation “ICO,” so close to “IPO,” would obscure what makes ICOs and tokens unique, especially in the eyes of regulators.